Call Lara at 252-249-5842 to discuss the best ad package for your business.

It feels like everyone is easing into the new year slowly, and our county commission is not immune. In an unusually short meeting, nearly all agenda items were passed quickly with little discussion.

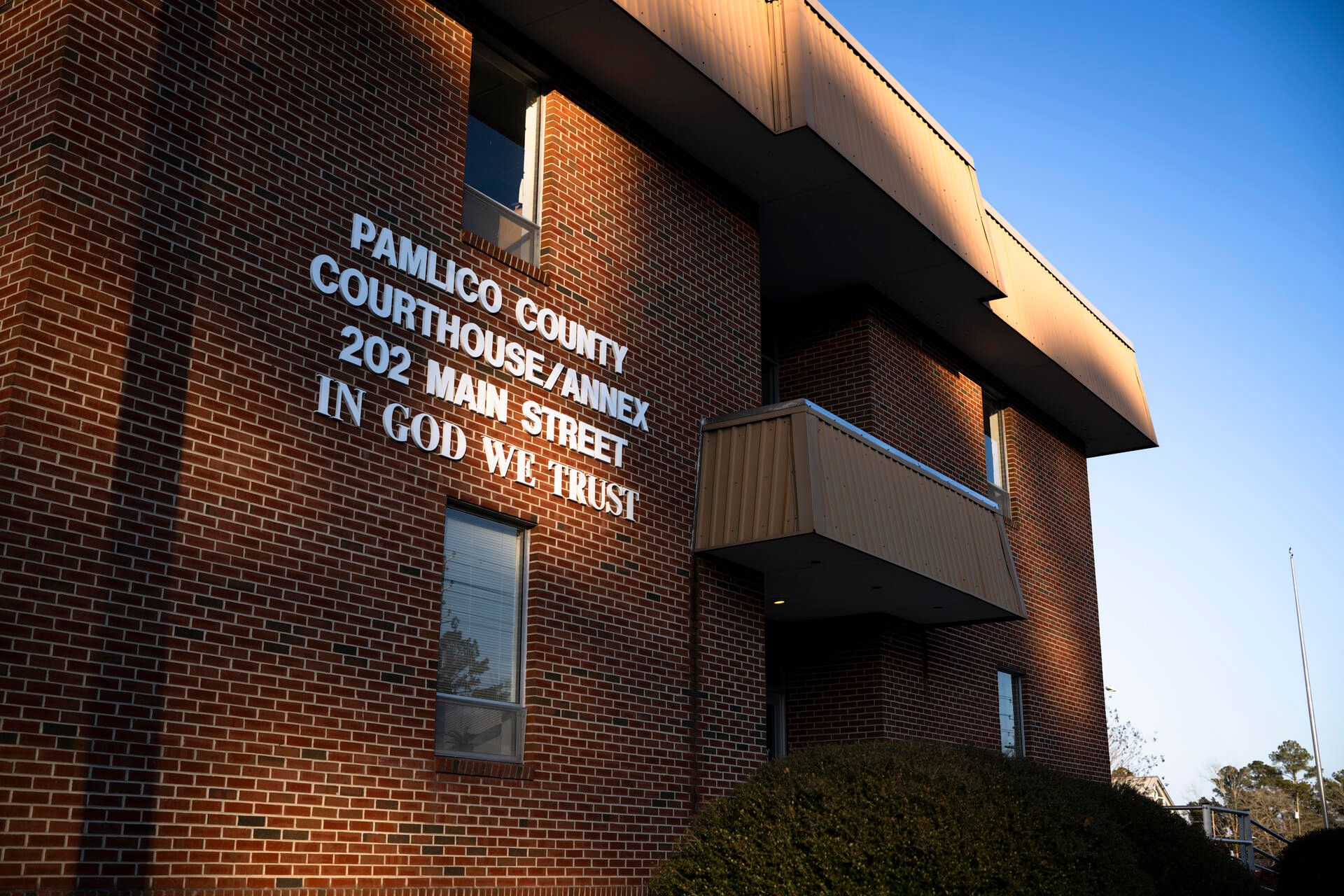

(Photo by Eleazar Yisrael)

Grant applications, board appointments, and a consolidation of services

On the agenda for the January 5, 2026 meeting were requests to approve the following:

budget amendments.

permission for Emergency Management and the Sheriff’s Office to purchase a steel craft building at a cost of $15,314.68.

permission for the Sheriff’s Office to use remaining funds from an EOC grant to buy audio-visual equipment for the EOC communication center room.

reappointment of Ed Riggs to the Eastern Carolina Council Board (ECC).

permission to apply for funding through the NCACC County Risk Group Reimbursement Program in the amount of $9,700.

permission to apply for $10,000 in grant funding from the NC

Department of Agriculture & Consumer Services Pesticide Container Recycling Program.

The board went into closed session to discuss a personnel matter.

The board also approved adoption of a resolution opposing the North Carolina Rate Bureau’s proposed dwelling insurance rate increase. Councilman Kenny Heath mentioned that a constituent who works in the insurance industry messaged him on Facebook about the potential rate hike. According to a memo from County Manager Mark Brewington, an insurance rate increase would lead to higher rental costs and could threaten economic stability in Pamlico County.

The North Carolina Rate Bureau (NCRB) filed a request with the North Carolina Department of Insurance on October 30, 2025, seeking a statewide average increase of 68.3%. North Carolina Insurance Commissioner Mike Causey has scheduled a public hearing on May 4, 2026 to address concerns about the proposed rate increase.

Late penalties can be costly

One agenda item did merit a few minutes of conversation: a request to waive a late listing penalty.

An owner of a local boat has appealed to the commission to have a $437.06 late penalty waived.

Property owners in Pamlico County must submit a list of the values of their taxable personal property by January 1 of each year. Taxable personal property in Pamlico includes items like mobile homes, cars, trucks, agricultural equipment, boats and jet skis. The Personal Property Listing Form can be printed and mailed to the Pamlico County Tax Office.

Dockmasters of area marinas submit documents listing boats in slips each year. While the county uses this list to determine taxable property within the county, it is not a substitute for the personal property listing form.

The form must be submitted by January 31 of each year. Failure to submit the form on time can result in a 10% penalty.

The county manager sent a memo to the commissioners advising that it is not the practice of the tax office to waive late listing penalties. The commissioners voted unanimously to uphold the penalty.

P.S. If this email didn’t come directly from us, but was forwarded by a friend, please sign up for our newsletter. This allows us to deliver Down County’s style of visual storytelling right to your inbox. We generally publish once a week.